- US markets opened Negative but closed at highest point of the day.

- U.S Futures right now are slightly Negative.

- SGX Nifty is around 13450.

- European Futures down by 3%.

- Until yesterday afternoon, European futures were down only 1%.

- After their markets open, they fell 3%.

- Yesterday was one of the worst Intraday crash in our Markets.

- Markets fell so fast with many people who couldn’t take any sort of action.

- Yesterday india VIX went up by 25%.

- Option Premiums are still very attractive.

- FII’s for the first time were Net sellers Yesterday.

- Whether they keep selling or this was a one off selling?

- Time will only say.

- I’ve warned previously to be cautious and start booking profits specially for Investors.

- One day could take away your monthly returns.

- No range , no support will work now.

- Just focus on price action.

- Now we are in a sell on rally mode until we defend any major support level.

- Yesterday’s fall was due to fresh Mutant Corona Virus cases detected in Europe.

- These cases are 70% more dangerous than Regular Corona Virus cases.

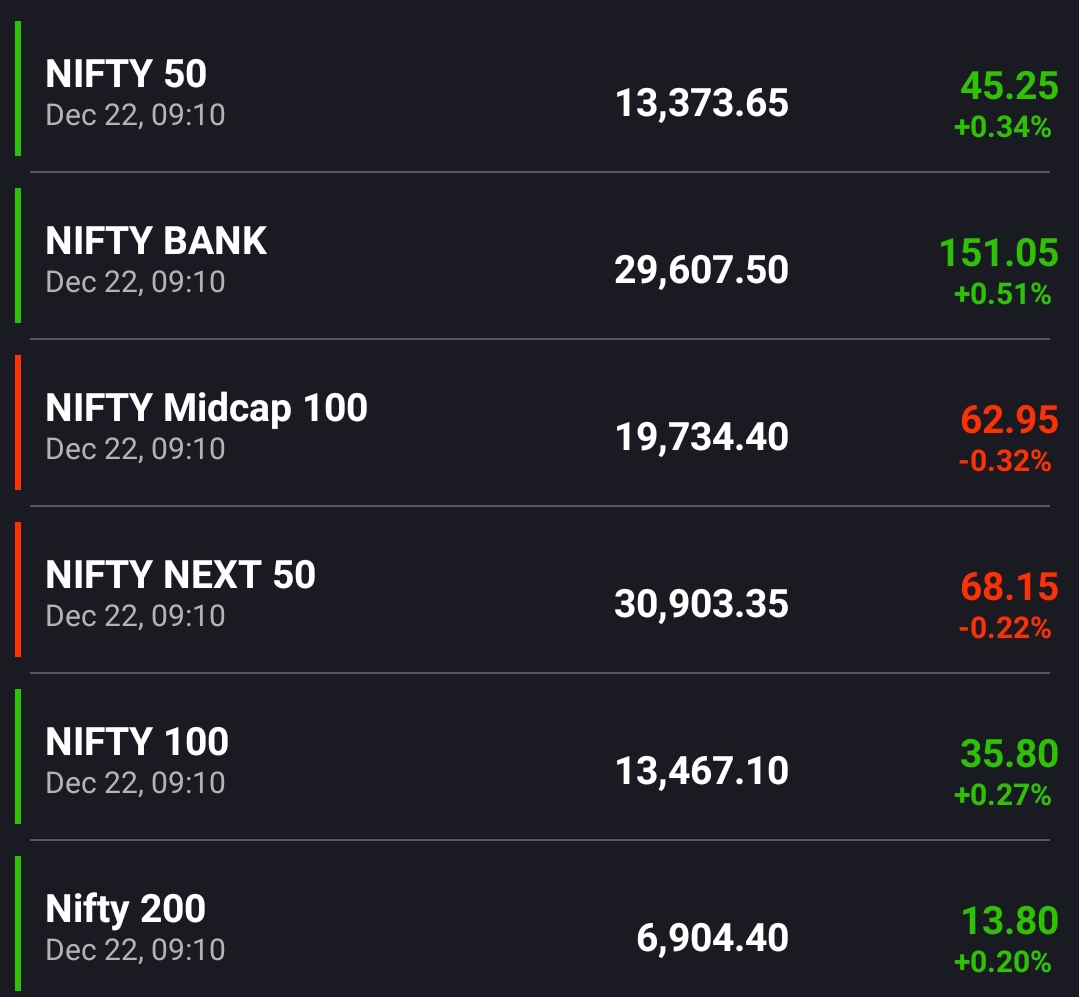

- Nifty might Trade between 13150 to 13500 today.

- Big range due to Unexpected Volatility.

- Today’s no chart based trade view, in today’s market high volatility to be seen, so trades completely made on the basis of price action.

Pre – Market Analysis (22nd Dec 2020)

Leave a comment